Blogs

Winner Take All: Sports Betting Meets Event Markets

You can place a bet on who will be the next President of the United States. You can speculate on the price of Tesla after its next earnings call. You can even put money on how many inches it will snow in New York City next month. You can take a position (or a bet) on any of these outcomes by simply making a trade on an exchange.

But to make a bet on something as straightforward as the outcome of a Knicks basketball game, you need to place a bet on a traditional sportsbook. A sports betting exchange, where sports bets can be bought and sold as they are with event markets, does not currently exist within the United States.

So what's the issue? Why not just place the bet with a sportsbook?

Well, sportsbooks do not operate like sports betting exchanges. Instead, on a sportsbook platform, the price of events aren’t driven by the public, there is a substantial vig on each side of the bet, winning players are often limited in the amount they can wager and are sometimes outright banned.

“Just like the tens of millions of Americans who have traded stocks or cryptocurrencies, I’m pretty comfortable with the concept of buying in at a certain price, and then when that price changes, selling. But trying to do that for sports betting right now is almost impossible,” explained Sporttrade Founder & CEO Alex Kane.

So why is it that sports betting exchanges such as Betfair exist in Europe but not in the United States? Legal, regulated online sports betting is far less mature than European markets, and exchanges are far more difficult to build than basic sportsbooks.

Binary options such as event derivatives have been around for decades. As all-or-nothing positions, traders are able to speculate on outcomes that will either occur or not occur. Whether speculating that Apple’s share price will reach $170 by the end of 2022 or that the Democrats will retain control of congress at the next election cycle, the events either happen or they don’t.

The shares are typically traded in contracts that close at $100 if the outcome occurs and $0 if it doesn’t. If you have a strong opinion about something that runs contrary to the conventional wisdom, there is money to be made on taking a position in that outcome. Or perhaps you want to use binary options to hedge off risk, like an aggressive stock portfolio that has downside risk if the economy enters a recession by the end of the year. If a recession were to occur, the money you’d lose on your stocks would be counterbalanced by the gains in your event contract position in “Will there be a recession?”

In the United States, there are ways for retail investors to speculate on stock prices, trade election outcomes, and profit from an overwhelming amount of prediction market outcomes. But if you want to buy an event contract on the Philadelphia Eagles to win the NFC East, there is currently no domestic outlet to do so, other than placing it in the form of a wager at a sportsbook, which does not offer the same benefits you’d find in a sports betting exchange.

2021-2022 NFC East Futures

That’s where Sporttrade comes into play.

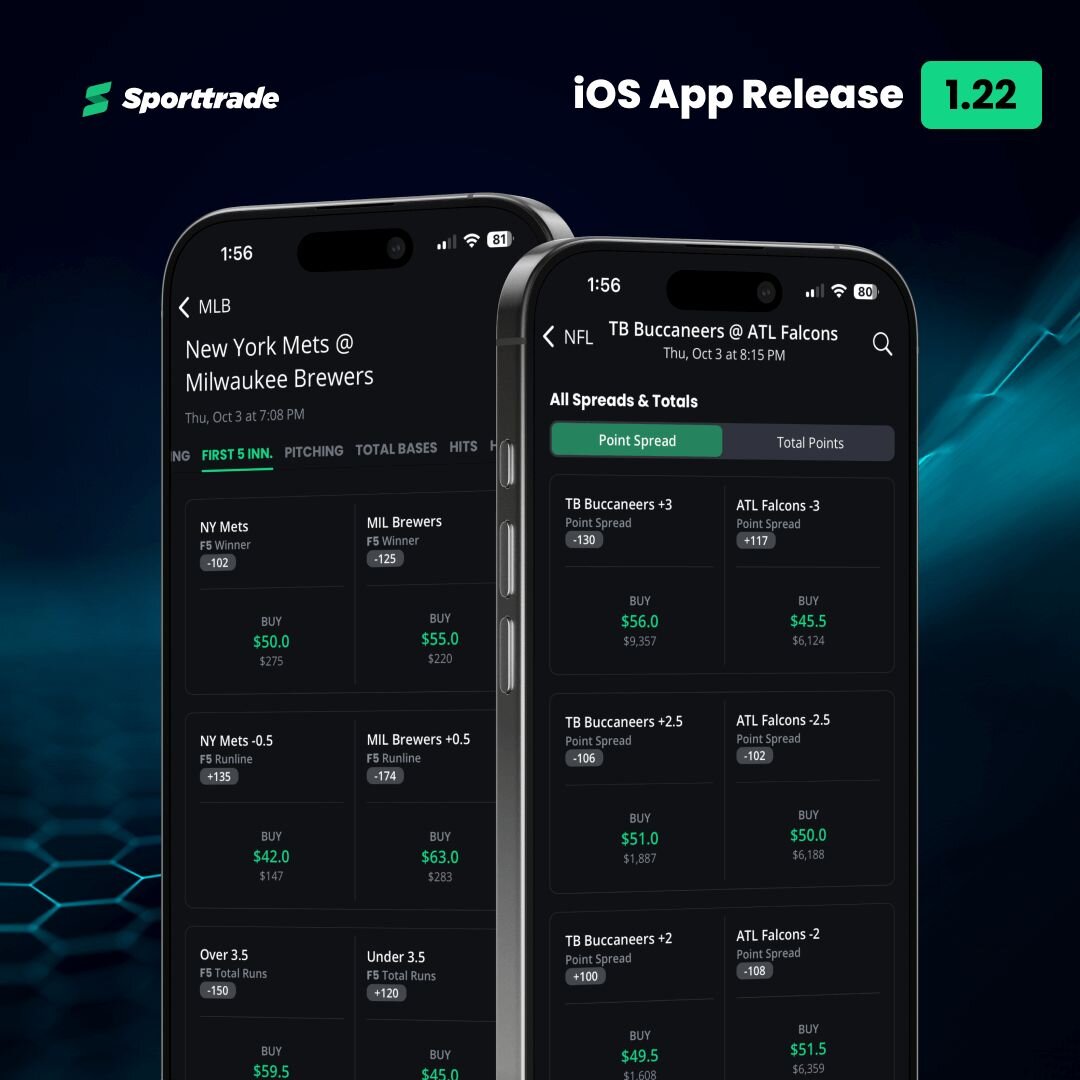

With a sports betting exchange, the same sort of binary option event trading that has been available for years on a range of topics will open up for sports traders to enter the market. The Rangers to win the Stanley Cup, the Bulls to cover the spread in Milwaukee, or the Buccaneers-Packers game to go over 47.5 total points. All of these contracts will now be offered.

"When I was introduced to sports betting, I realized that it looked a lot like financial markets 30 years ago, with wide spreads, single dealer platforms… You can't put limit orders in, customers can get limited or banned," said Kane on a recent panel at the Futures & Options Expo. "We saw a huge opportunity to build something that looked and felt a lot more like Schwab, Robinhood, FTX, or Coinbase. We saw how many Americans were voracious about day trading and how big the sports betting opportunity is.

“This is where Sporttrade sits: at the intersection of sports betting and stock trading. Simply put, this isn't betting sports — it's trading sports.”

There is a desire for both retail and institutional traders to enter the sports trading space, the only thing holding them back is the lack of access in the U.S.

“The U.S. is behind the rest of the world in terms of the kind of market structure, the kind of agency for the end user, and the spreads that you have to pay to get access to the market,” said Scott San Emeterio, the Founder and CEO of BallStreet Trading on a panel at SBC North America.

Using a sports betting exchange will feel very similar to the experience customers expect on Robinhood or FTX, with words like “buy”, “sell”, “position”, “cost basis” as opposed to old school betting terminology. And while trading on a sports betting exchange is betting, not investing, the recent explosion of retail trading will mean many customers will be more comfortable interacting with betting via the trading mechanism they’ve grown accustomed to.

Sporttrade is slated to roll out to customers in New Jersey in 2022, making it the first U.S. based regulated sports trading app.